florida death inheritance tax

One of the most pressing and important issues is what to do with the persons estate. However there are actually several steps of the probate process that the executor must complete before transferring any assets.

What You Need To Know About Estate Tax In Florida St Petersburg Estate Planning Lawyers

33 States with No Estate Taxes or Inheritance Taxes Even with the federal exemption from death taxes raised retirees should pay more attention to estate taxes and inheritance taxes levied by states.

. Step-up basis means the beneficiarys tax basis in the inherited property will be the market value at the date of the grantors death. California tops out at 133 per year whereas the top federal tax rate is currently 37. The person named as trustee is responsible.

This can be significant for appreciated assets. What You Need to. Florida also does not assess an estate tax or an inheritance tax.

New Jersey imposes inheritance taxes on decedent estates at the time of death. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as estate. Unfortunately practical issues must still be resolved during this difficult time.

Revocable trusts can offer beneficiaries a step-up basis at death. Maryland is the only state to impose both. This is based on where the person legally lived when heshe passed away.

The Pennsylvania Inheritance Tax is a Transfer Tax. Iowa has an inheritance tax but in 2021 the state decided it would repeal this tax by 2025. The state constitution prohibits such a tax though Floridians still have to pay federal income taxes.

This article explains in depth how the inheritance tax may affect you. 14 This also marks the climax of controversy between the states and the federal government as estates were facing multiple layers of taxation. The strength of Floridas low tax burden comes from its lack of an income tax making them one of seven such states in the US.

All the same federal tax rates are typically higher than state taxes. The federal estate tax is collected on the transfer of a persons assets to heirs and beneficiaries after death. This is a significant benefit compared to gifts made during your lifetime.

Twelve states and Washington DC. If you have recently gone through the death of a loved one you are probably dealing with the grieving period now. It is different from the other taxes which you might pay regularly.

District of Columbia Florida Alabama and Nevada. There are two types of Inheritance Tax resident and non-resident. Once the owner of a revocable trust dies the trust becomes irrevocable and cannot be changed.

The total tax due is calculated by adding up the fair market values of all the decedents assets as of his date of death although the executor or administrator of the estate can elect to have everything valued on an alternate date six months later instead. Even though California wont ding you with the death tax there are still estate taxes at the federal level to consider. Impose estate taxes and six impose inheritance taxes.

In 1924 state inheritance taxes accounted for 82 of total state tax revenue 13 and by 1925 only four jurisdictions remained without an inheritance tax. See Decedent Information for more information on resident and non-resident Inheritance Tax. Client Review I worked for Peter Klenk for 4 wonderful years.

When most people think of executing a will they might think only of delivering inherited assets to beneficiaries. The federal estate tax goes into effect for estates. As a beneficiary its natural to wonder how long it will take before the process ends and you receive any inheritance coming.

Inheritance taxes in Iowa will decrease by 20 per year from 2021 through 2024. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. Whats New for 2022 for Federal and State Estate Inheritance and Gift Tax Law Find out whats changed in 2022 for inheritance law.

I cant speak highly enough of everyone at the firm. The date of death value of the assets and debts that the decedent owned.

Florida Inheritance Tax Beginner S Guide Alper Law

Florida Inheritance Tax Beginner S Guide Alper Law

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

U S Estate Tax Exposure For Canadian Residents Who Are Not U S Citizens Manulife Investment Management

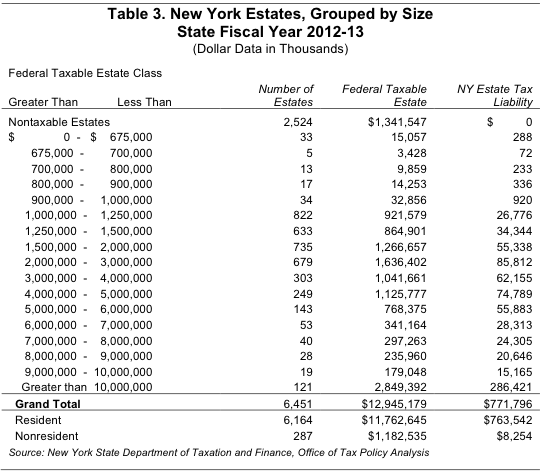

New York S Death Tax The Case For Killing It Empire Center For Public Policy

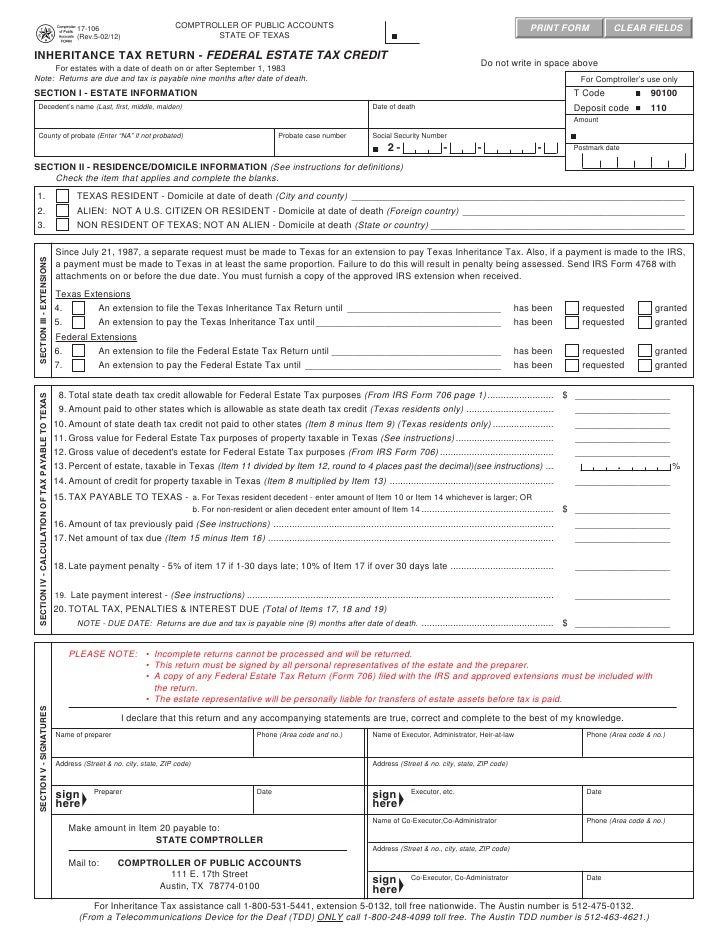

Texas Inheritance Tax Forms 17 106 Return Federal Estate Tax Credi

Florida Estate Tax Rules On Estate Inheritance Taxes

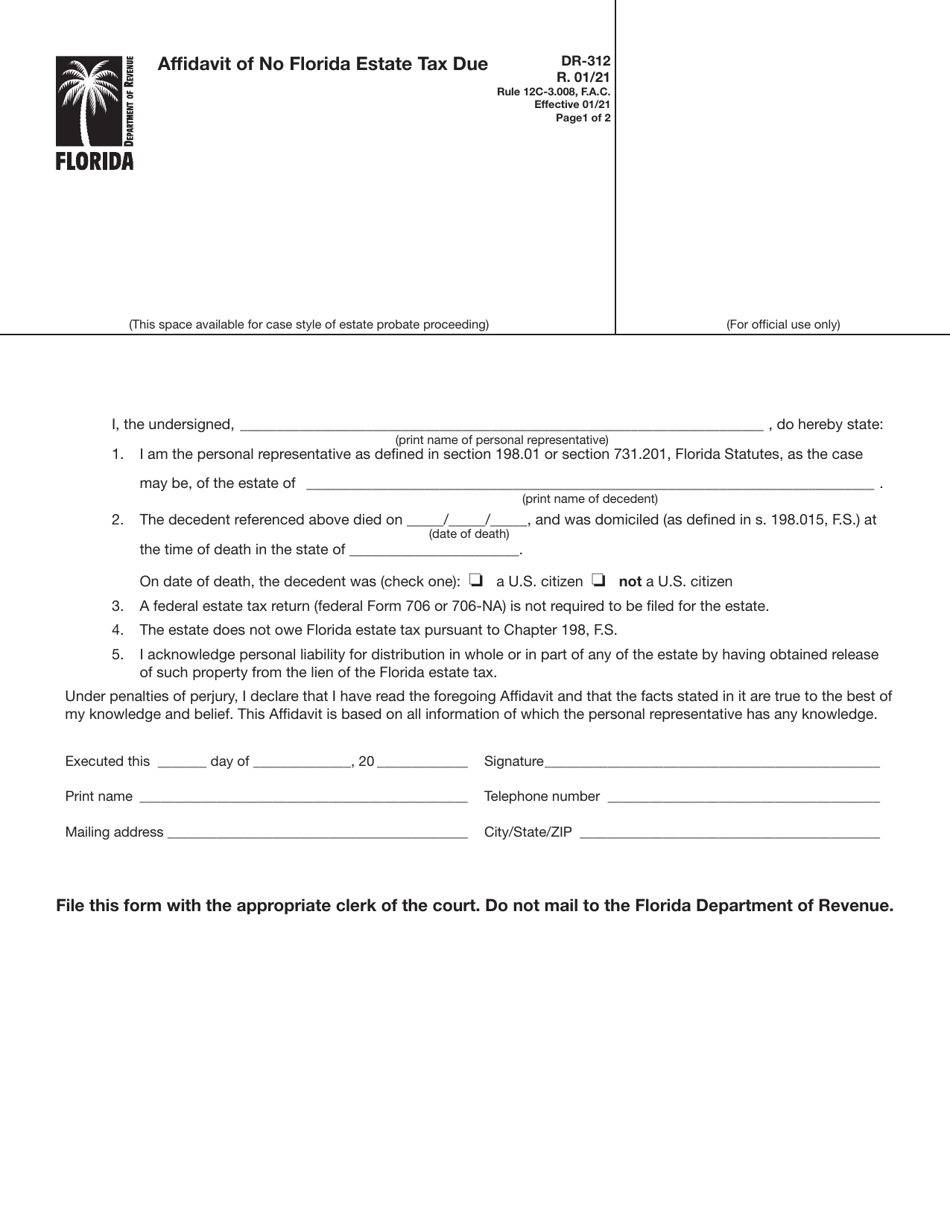

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Death Tax Is A Killer The Heritage Foundation

Kill The Inheritance Tax Pittsburgh Post Gazette

Florida Attorney For Federal Estate Taxes Karp Law Firm

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Taxes In Florida Does The State Impose An Inheritance Tax

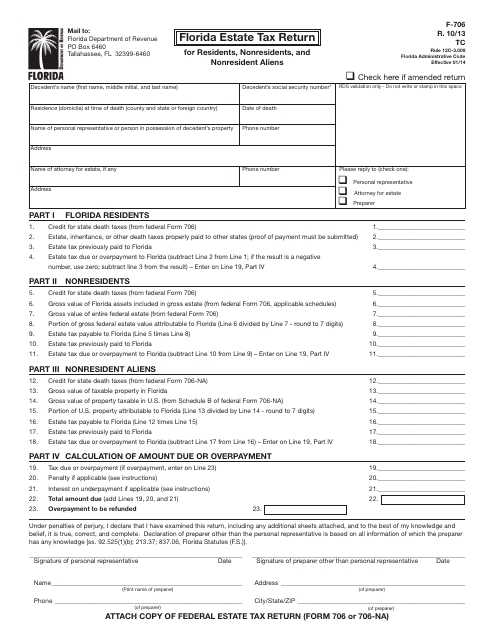

Form F 706 Download Printable Pdf Or Fill Online Florida Estate Tax Return For Residents Nonresidents And Nonresident Aliens Florida Templateroller

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Eight Things You Need To Know About The Death Tax Before You Die